Refreshment Hub

N004/2024

Budget 2025 Insights on Employment

Budget 2025 Impact in Employment & Individual (Tax Reliefs)

What are the impacts of Budget 2025 in Employment & Individual (tax reliefs)?

1. Tax relief of disability workforce increased from RM 6000 to RM 7000; disabled spouse increased from RM5000 to RM 6000; unmarried disabled children be increased from RM6,000 to RM8,000.

2. Tax exemption on child care allowance given by employer be expanded to include elderly care (parents/grandparents) up to RM3000.

3. Private Retirement Scheme (Salary Deduction Programme) or Individual PRS tax relief up to RM3000 be extended for 5 years (YA2030).

4. Relief for full medical check-up extended to influenza test kit, purchase of self-testing medical devices (e.g. blood pressure monitor and thermometer) and fees for disease detection examination conducted at clinic or hospital, limited to RM1000.

4. Fees on early intervention programme and continuous rehabilitation treatment for children aged below 18 years be increased to RM6000.

5. RM1,000 for expenses on sports equipment and activities for self, spouse and child be expanded to parents.

6. RM 8000 Medical treatment, special needs, and parental care expenses be expanded to grandparents, treatment inclusive vaccination (limited to RM 1000).

7. Tax relief on education and medical insurance be increased to RM 4000 from RM 3000.

8. Individual income tax relief of up to RM8,000 on net annual savings in SSPN be extended for 3 years (YA2027); withdrawal for education cost will not affect the eligible amount for tax relief.

9. Tax relief on housing loan interest payment for first residential home up to RM7000 per year provided that the residential home must not be used to generate any income; the sales and purchase agreement must be executed from 1 January 2025 until 31 December 2027.

10. Tax relief on nursery or kindergarten fees up to RM3000 be extended to YA2027.

11. Purchase of food waste composting machines for household use, with the relief limit remaining at RM2,500

12. Annual dividend income exceeding RM100,000 be tax rate at 2% chargeable dividend income after taking into account allowances and deductions.

13. Purchase of ICT equipment, computer software packages and consulting fees be given accelerated capital allowance that can be fully claimed within

a period of 2 years (20% of inital allowance, 40% of annual allowance) till YA2025.

14. One-off deduction up to RM500,000 on expenses for capacity building and software acquisition incurred by employers for implementing FWA upon verified by Talent Corporation Malaysia Berhad.

15. It is proposed a 50% further deduction be given to employers who provide additional paid leave of up to 12 months for employees caring for children or ill or disabled family members. The application has to go through by Talent Corp Berhad.

Warm reminder:

To view full and completed version of budget 2025, plesae email to us at simeduc2u@gmail.com

Thank you.

Disclaimer as at the foot page.

N003/2024

ePCB Plus REPLACED eCP39/ ePCB/ eData PCB

ePCB Plus is NEW platform to submit Monthly-Tax-Deduction

If you are using eCP39/ ePCB/ eData PCB to submit monthly-tax-deduction those far, you may need to pay attention to this article.

LHDN has established this portal to replaced aforesaid portals under https://mytax.hasil.gov.my

You need to register as user once logged into the portal whether as employer/ employer representative/ PCB administrator/ individual.

Effective today (24 September 2024), employer/employer representative/PCB administrator is allowed to proceed to MyTax portal, logged with individal credential and set up the role access into ePCB Plus portal to ease next month submission. BUT, if those far you are opted in to credit monthly-tax-deduction via online banking, then there is not difference on your current processing.

A comprehensive guide on ‘how to set up the role in ePCB Plus, please email to simeduc2u@gmail.com

Warm reminder:

Phrase one of ePCB Plus is allowing relevant parties to select appropriate role at ePCB Plus. Grab your time today to complete the necessary.

Should you require an assistance, please reach us at ask@simeduc.com or simeduc2u@gmail.com

Thank you.

Disclaimer as at the foot page.

N002/2024

Foreign Worker Covered under Invalidity Scheme Effective 1st Jul 2024

SOCSO extended 24hrs protection thru Invalidity Scheme (Skim Keilatan) to foreign worker.

If you are employing a group of foreign workers, it is your obligation as employer to ensure foreign workers are contribute starts from July 2024 contribution.

It is applicable to all foreign workers who possess valid pass or permit issued by Immigration of Malaysia.

Your foreign workers may curious on the benefits bring-forth with this contribution. Here are the answer for you:

- Invalidity pension

- Invalidity grant

- Constant-attendance allowance

- Survivor’s pension

- Rehabilitation facilities

- Funeral benefit

Warm reminder:

Change foreign worker’s employee profile statutory setting from contribute under Second Category to First Category effective 1st July 2024.

Should you require an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N001/2024

Furnish CP8D via e-Data Praisi/ e-CP8D ONLY.

YA2023 Employee’s Remuneration Information Can Only Be Submitted at e-Data Praisi/ e-CP8D by 25 February 2024.

If you planned to validate CP8D after back from Chinese New Year holiday, you might caught in fire-fighting scenario as this year IRB made it a compulsory for employers to disclose CP8D online via MYTAX e-Data Praisi/ e-CP8D.

The exclusion only for employers which are Sole Proprietorship, Partnership, Hindu Joint Family and Deceased Person’s Estate who do not have employees are exempted from submitting C.P.8D).

To release you from a happy festival celebration, you need to take note of followings:

- Form e-E will only be considered complete if C.P.8D is submitted on or before the due date for submission of the form.

- Employers are need to furnish C.P.8D via e-Filing if with Form e-E which is submitted via e-Filing.

- Employers who have submitted information via e-Data Praisi/e-CP8D before 25 February 2024 are no longer required to complete and furnish C.P.8D via Form e-E.

- C.P.8D which does not comply with the format as stipulated by LHDNM is unacceptable.

- The C.P.8D data may be deemed incomplete and the e-E Form may also be deemed incomplete form and unacceptable if the information column is left blank or does not adhere with the layout standards.

- C.P.8D information must contain ALL particulars of employees (including full time / part time / contract employees and interns) and individuals who are responsible or engaged in the management of the organization (including company directors, co-operative society’s board members, association’s controlling members and partners of limited liability partnership)

Warm reminder:

Due date to furnish Form E for the Year of Remuneration 2023 is 31 March 2024. Failure to submit the Form E on or before 31 March 2024 is a criminal offense and can be prosecuted in Court.

Should you require an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N001/2023

Payroll Impact on Revision of Tax Structure & Expansion Tax Relief

New Income Tax Rate for Resident Individual and Benefits on Expansion of Certain Tax Reliefs

Payroll adminstrator may anticipate a scenario some happy wherest some are sad as impact of tax restructuring. Anynow, we shall compliance to the changes as per announcement by authorities from time to time.

The proposed tax rates for resident individuals of the following chargeable income bands will be reduced by two percents:

- RM35,001 to RM50,000 (-2%)

- RM50,001 to RM70,000 (-2%)

- RM70,001 to RM100,000 (-2%)

Subsequently the following chargeable income bands will be increased by 0.5 to 2.0 percents:

- RM100,001 to RM250,000 (1%)

- RM250,001 to RM400,000 (0.5%)

- RM400,001 to RM600,000 (1%)

- RM600,001 to RM1,000,000 (2%)

Anyhow, there are few expansion of tax reliefs that have a significant positive impact on our ability to navigate through difficult circumstances. With these expansion, now you can restructure your financial planning in a smarter way.

What are the expansion?

- Increase tax relief on medical treatment expenses up to RM10,000 effective YA2023.

- Expansion tax relief on life insurance expenses, covers volunteerily EPF contribution effective YA2023.

- Extension of child care fees paid to registered child care centres/ kindergartens for a child aged 6 yrs and below for YA2023 & YA2024.

- Extension tax relief of net deposit into Skim Simpanan Pendidikan Nasional (SSPN) for YA2023 & YA2024.

Warm reminder:

MTD Calculation for month of May until December as per above rate. Total remuneration, MTD paid and the deductions/rebates will be accumulated and brought forward from month to month until month of December in a current year.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N012/2022

Additional Cost on SOCSO & EIS Liability

Cost of Hiring Increased vs. Increased Benefits Payment Rate

Whenever the majority of us focus on Amendment Employment Act 2022, these two Acts have been amended as well to give more protection in terms of benefits to his members.

Both Act 4 (Employee’s Social Security Act) and Act 800 (Employment Insurance System) the wording “Four Thousand Ringgit” has been substituted for “Five Thousand Ringgit”. It means that effective 1st September 2022, both employer and employee are required to contribution based on new table as amended in EMPLOYEES’ SOCIAL SECURITY (AMENDMENT) ACT 2022 and EMPLOYMENT INSURANCE SYSTEM (AMENDMENT) ACT 2022.

What you (boss/ HR practitioners/ Payroll practitioners) need to do as follows:

- ensure your payroll system is updated with the latest contributions rate.

- ensure the new rate is reflected on SOCSO & EIS.

- ensure September 2022 payroll reflects new rate of contribution for those wages more than RM 4000 per month.

- ensure October 2022 remittance of both share of contribution (employer-employee) reflects the new rate as mentioned.

- encourage to brief your employee of the changes on the contribution rate as in compliance with the amendment Acts.

What benefits do the employees have?

More comprehensive social protection to contributors and their dependents, such as temporary and permanent disability benefits, dependent’s benefit, survivors’ pension, invalidity pension etc.

Details refer back to SOCSO.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N011/2022

“What matter most to my company in Employment (Amendment ) Act 2022?”

What I should be awared of?

Even though published over the media that Employment (Amendment) Act 2022 enforcement date will be deferred to 1st January 2023, good to ready with necessary before comes to the time.

What employer/ HR/payroll practitioners need to review/update into system are:

* review daily and weekly normal working hours to comply with 45hours/week;

* review payroll setting of overtime pay based on normal working hours;

* review payroll setting of calculating incompletion month salary formula;

* leave setting: separate entitlement of sick leave (14,18,22) and hospitalization (60) leave;

* leave setting: extend duration of maternity leave to 98 days;

* leave setting: create new paid paternity leave entitlement and set eligibility;

What to update into HR policy and employee handbook:

* all of above points;

* eligibility of paternity leave ;

* flexible work arrangement policy;

* anti employment discrimination policy;

* sexual harassment policy and awareness;

* suggest brief all HODs about amendment of the Act and discuss FWA prior setting policy

Details of amendments need to refer back to the Employment (amendment) Act 2022.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N010/2022

“What is TP3?”

What is TP3?

This is a form of information related to employment with previous employers of current year for the purpose of monthly tax deduction.

An employer has to ask the new employee to complete the form whenever they are newly join the Company.

For those has filed in TP1 in their previous employment is required to complete Part D in TP3, without supporting documents/receipts.

All the receipts and/or supporting documents shall be safe keep by the employee himself for audit purpose.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N09/2022

“What an employee can do to optimize their pocket money? via TP1?”

What is TP1?

While inflation is shouting loud and impacting our life, what you can do to optimize the pocket money without salary increment?

YES, via TP1 form submission to the company prior salary processing cut off.

Here are tips of seizure the opportunity:

* Every employee do have right to file TP1 at least twice in a year.

* If the expenses involved big numbers, claim it without waiting ITRF.

* Whilst the number just a little, you do have chance to file a claim by periodical.

* Keep track the eligibility and limitation before file a claim.

* Integrity is top concern while exercising TP1. Therefore employee shall keep all the receipts and/or supporting documents for audit purpose.

* Finally, make a good ledger on the claims that has been filed.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N08/2022

“Are you ready for the upcoming Amendment 2021 – Employment Act 1955.”

|

What you should do in next?

Like it or not, now is pending for Royal assent to gazette the changes. You as representative of the employer, are you ready for the changes? What you should do in response to the amendments?

There are few areas you should look into it:

* Payroll perspective

* Manpower budget perspective

* Hiring plan

* Salary structure

* HR metrics and analysis

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N07/2021

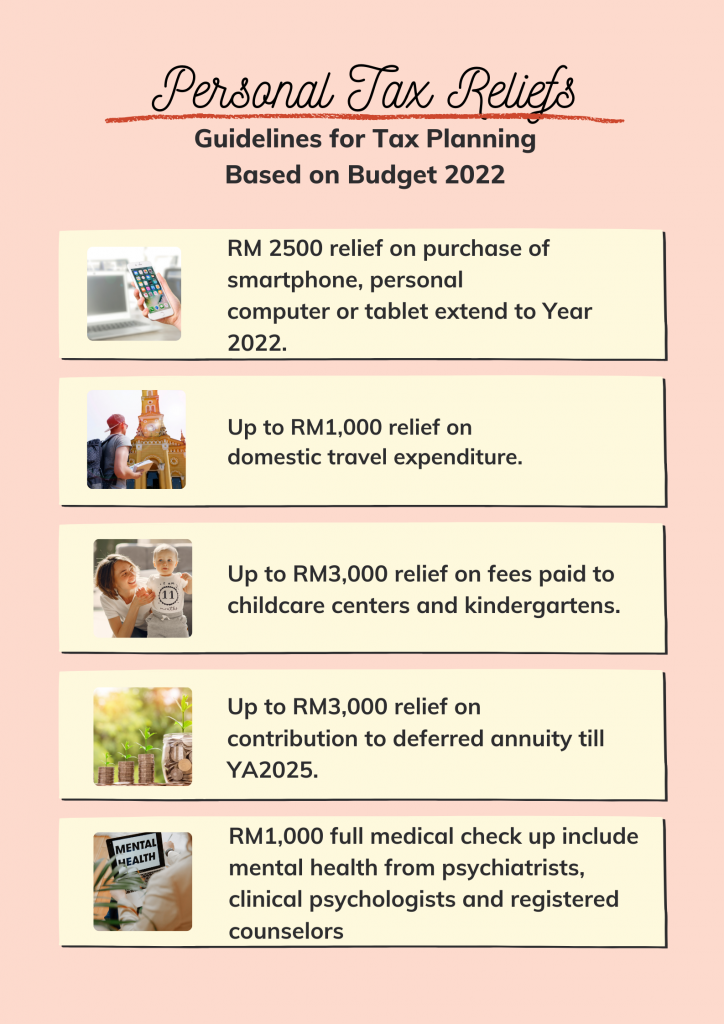

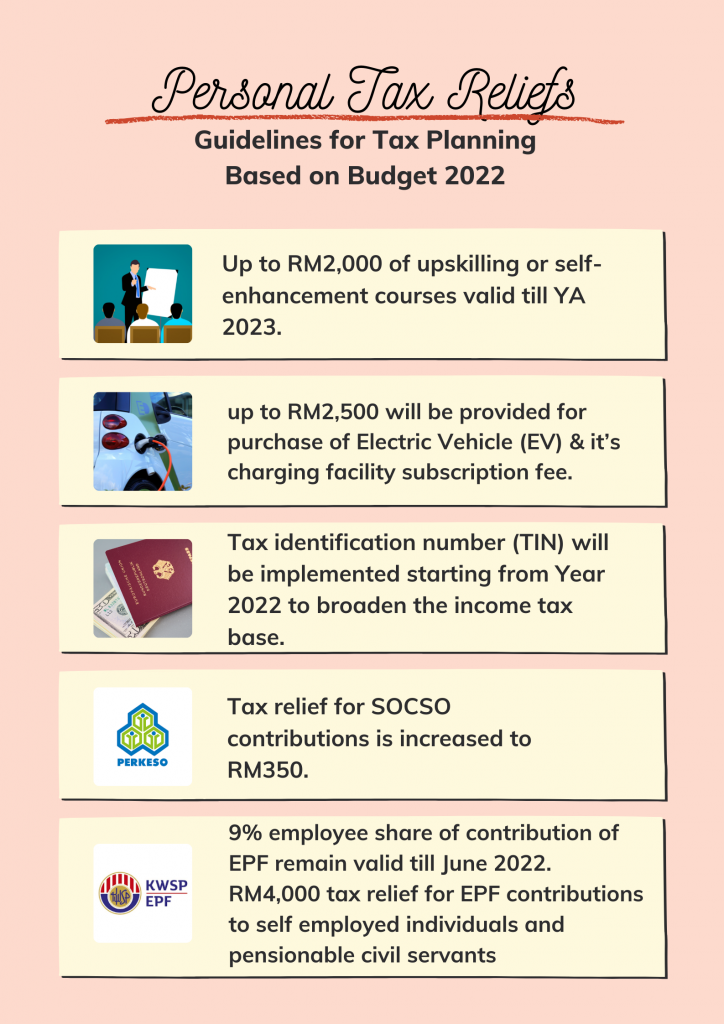

“Year 2022 Budget Impact on Payroll and Personal Tax Reliefs”

|

|

What are the impacts?

Payroll Setting Perspective:

* EPF – 9% of employee share of contribution remain valid til June 2022.

Individual Tax Optimization:

* SOCSO – tax relief up to RM350, instead of RM 250 effective Y2022.

* Tax Identification Numbers (TIN) will be implemented effective Y2022.

* Plan for future days with tax relief up to RM3,000 till year 2025 through Private Retirement Scheme (PRS).

* Buy tablet to support online learning wil lbe qualified for tax relief up to RM2500, valid till Y2022.

* If you still send childs to daycare or kindergarten, you will be eligibled to claim tax relief up to RM3,000.

More details, please visit budget touchpoints Year 2022.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N06/2021

“Amendment of Employment Act”

|

|

What are the impacts to the employers?

* Manpower planning and in-time upskilling with the extension of maternity leave and adoption of paternity leave.

* DEI become global practice

* With hybrid workplace arrangement, a dynamic performance management tool shall be emplaced..

* Comprehensive HR policy is a must which included procedure of reporting and prevention of sexual harassment.

* Legal compliance of payroll calculation.

Should you required an assistance, please reach us at ask@simeduc.com

Thank you.

Disclaimer as at the foot page.

N05/2021

“Kerja Dari Rumah dan Fleksibel (WFH).”

“Whatsapp tidak dibalas setelah membacanya”

“Telefon dihidupkan, tetapi tidak ada yang menjawab”

“Super urgent, Bos marah nak potong gaji pekerja”

Apa yang salah? Semuanya normal ketika bekerja di pejabat; sekali bekerja dari rumah, tidak melaporkan diri dan hilang dari kerja. Ketidakbertanggungjawaban menyebabkan HR bertindak dengan surat amaran dan seterusnya.

Periksalah dengan langkah-langkah tertera dibawah sama ada sudah diamalkan di syarikat anda:

* Dasar dan prosedur kerja jarak jauh (supaya tidak panik tidak kira berapa banyak MCO)

* Rekod kedatangan jarak jauh (anda boleh log masuk melalui telefon, jika anda memilih sistem yang betul)

* Dasar pengurusan prestasi yang bersesuaian dengan senario semasa (seperti OKR)

* Ada rancangan ganjaran? Jangan tunggu sampai akhir tahun.

* Adakah anda memahami kekurangan dan kelebihan pekerja? Sekiranya tidak, anda benar-benar perlu bertindak sekarang!

Hanya pekerja yang didengar, dihargai, dan dirancang kerjaya masa depan berserta pendapatan yang boleh dijangka akan bekerja keras untuk majikan.

Apa lagi tunggu?

Refer to disclaimer at the foot page.

N04/2021

“Penggajian: Sering Dikira Tetapi Nilai Strategik Sentiasa Diabaikan.”

Penggajian merupakan salah satu fungsi yang sering diabaikan. Lazimnya, ia merupakan fungsi pentadbiran yang diperlukan, tetapi tidak mendapat perhatian jika ia dapat dijalankan dengan tepat. Apabila syarikat berkembang, sistem penggajian akan menjadi sangat kompleks dan menyebabkan kos penyelenggaraan yang tinggi.

Justeru,pasaran penyumberan luar proses perniagaan gaji (BPO) kini lebih matang berbanding dengan sebelumnya. Kini banyak syarikat menceburin dalam pelbagai perkhidmatan yang memerlukan pakar-pakar gaji dan cukai dan secara tidak langsung menyebabkan struktur kos yang amat kompetitif.

Akan tetapi, kerja sebagai rakan strategik jauh lebih lancar pada masa ini dengan alat penyebaran dan pemindahan data yang cepat dan pantas.

Justeri, pakar-pakar penggajian tetap mempunyai pasaran pada era automasi and integrasi ini. Asalkan kamu menguasai ilmu penggajian dan topik-topik yang berkaitannya.

Refer to disclaimer at the foot page.

N03/2021

“Kepentingan Buku Panduan Pekerja.”

Buku panduan menunjukkan budaya sistem syarikat dan menyenaraikan tatakelakuan kakitangannya.

Buku Panduan Pekerja bukan sahaja sebagai rujukan menyelaraskan praktis-praktis, ia juga sebagai panduan kepada para penyelia dalam menjalankan tugas masing-masing.

Langgan kalendar pakar untuk perkhidmatan menyediakan Buku Panduan syarikat anda.

Refer to disclaimer at the foot page.

N02/2021

“Pengurusan Penggajian Yang Berkesan.”

Pada era automasi dan digitalisasi, ramai bergantung kepada sistem dalam proses penggajian. Manakala, cara-cara pengiraan dan aplikasi pengetahuan telah dicampak ke belakang.

Soalan-soalan berkenaan pengiraan terutamanya percukaian banyak bergantung kepada vendor yang mungkin bukan pihak yang bersesuaian untuk menjawab.

Adakah kamu bersedia menambah nilai diri sebagai pentadbir gaji?

Langgan calendar pakar kami untuk slot persendirian.

Refer to disclaimer at the foot page.

N01/2021

“Tanggungjawab Anda Sebagai Rakan Perniagaan Sumber Manusia.”

“Pekerja tidak dibayar gaji 2 bulan, diberikan RM43000 untuk pemecatan yang terpaksa (constructive dismissal)”, reported by FMT.

Apa peranan anda sebagai Rakan Perniagaan Sumber Manusia (HRBP)? Adakah kamu bersedia memberi nasihat yang sewajarnya kepada majikan walaupun ia tidak sedap ditengar?

Terokailah apa yang harus anda ketahui sebagai HRBP.

Refer to disclaimer at the foot page.

DISCLAIMER

- all articles sharing are for general information only.

- the sharing is at the level best knoweldge as at the date of publishing.

- readers are encourage to further consider or obtain advise from appropriate bodies or agencies, therefore it shall not be taken as legal advise nor for official auditing purposes.